by Mark Nemtsas | Jan 20, 2009 | How To, New Features, Tips and Tricks, Using the Software

In part 1 of configuring Time Clock MTS to comply with Californian Overtime Regulations I covered how to setup the software to calculate this sort of overtime automatically. In this second part I’ll cover how it is displayed in reports.

Report Template Changes to Show Overtime Rate 2

Modifying Report Templates

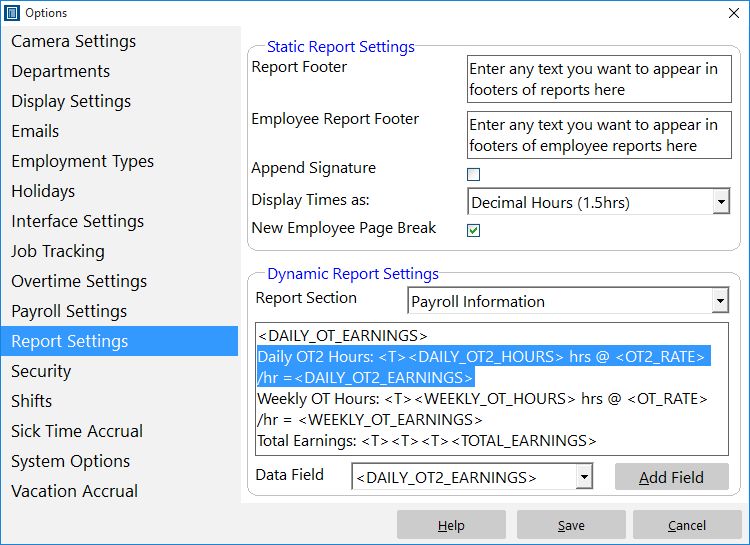

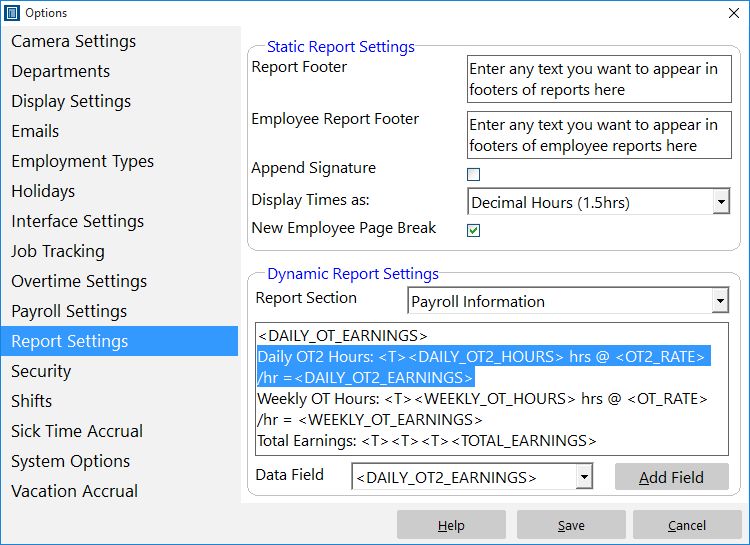

If you have only just started using Time Clock MTS then you will not need to modify your reports to display overtime rate 2 as the software will have set it up by default. You can therefore ignore this part of this article. However, if you are an existing user of Time Clock MTS upgrading an old version of the software to a newer version that supports the Californian Overtime Regulations then you will need to modify the Payroll Information report section template. In the image above you can see the relevant section that I have added to the report section template. I have added this immediately under the line that was already there that displayed the overtime rate 1 information. The line I have added is:

Daily OT2 Hours: <T><DAILY_OT2_HOURS> hrs @ <OT2_RATE> /hr = <DAILY_OT2_EARNINGS>

Basically this displays the heading ‘Daily OT2 Hours:’ along with the actual hours worked at overtime rate 2, the rate of pay for overtime rate 2 (which should be set to double time) and the earnings at overtime rate 2. If you don’t understand what the report section templates are then you should take a look at my posts on customizing Time Clock MTS reports in part 1, part 2, and part 3.

Overtime Rate 2 Report Date in Payroll Summary Section

Viewing Overtime 2 Payment Amounts in Reports

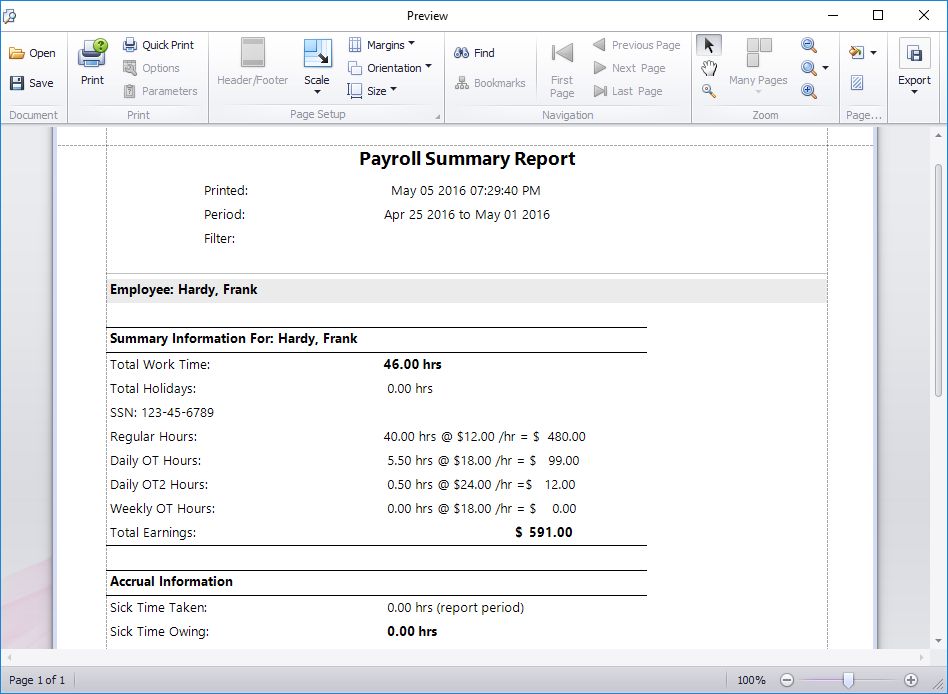

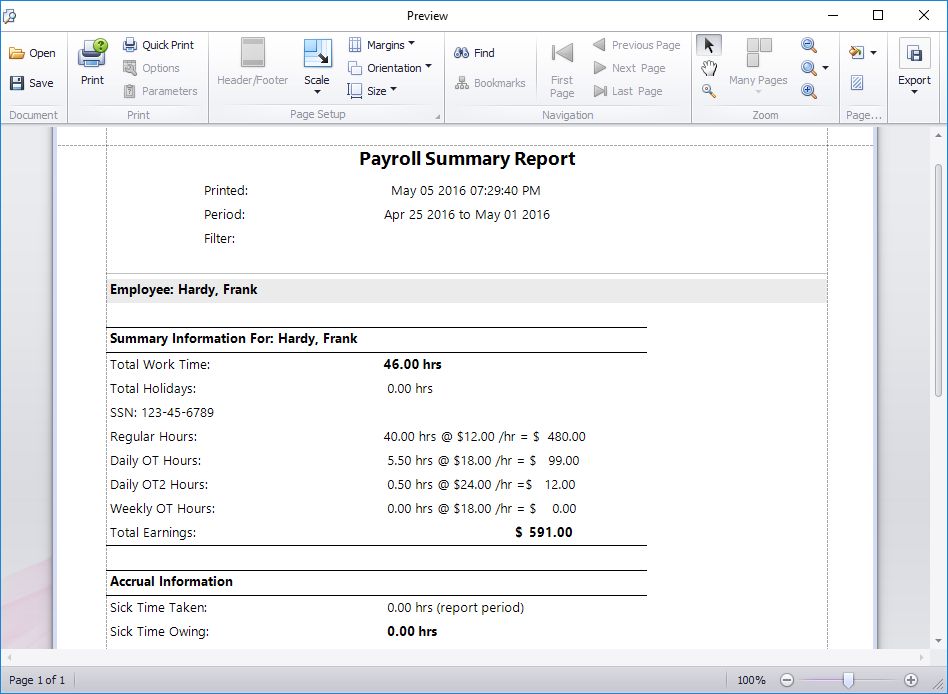

If you choose to display the payroll summary section in a report (or run the payroll summary report) then you will be shown the new overtime rate 2 payment information as per the image above. You can see in this example that the employee is entitled to 1 hour of overtime at overtime rate 2 which is set to double the normal rate.

So, that’s all there is to it. It is very simple to configure Time Clock MTS to comply with the Californian overtime regulations. Doing so will give you significant productivity improvements come payroll calculation time, and will help to you do reduce and eliminate payroll errors. As always please email me if you have any questions.

by Mark Nemtsas | Jan 20, 2009 | How To, New Features, Tips and Tricks, Using the Software

Employee Settings to Suit California Overtime Regulations

California has it’s own set of peculiar regulations for payment of overtime to employees. They are reasonably complex and are tedious when you have to apply and calculate them manually. As of Version 2.1.11 Time Clock MTS is now fully compliant with these regulations saving you a lot of time calculating your payroll and overtime pay. You can read about these regulations in detail on the Californian Department of Industrial Relations website. The relevant section of the page that applies (given that an employee is not subject to an exemption or exception) is:

1. One and one-half times the employee’s regular rate or pay for all hours worked in excess of eight hours up to and including 12 hours in any workday, and for the first eight hours worked on the seventh consecutive day of work in a workweek; and

2. Double the employee’s regular rate or pay for all hours worked in excess of 12 hours in any workday and for all hours worked in excess of eight on the seventh consecutive day of work in a workweek.

Thus overtime can be split into two parts:

- Daily Overtime: hours worked between 8 and 12 in a single day are subject to 1.5 times the normal rate of pay. Hours worked in excess of 12 hours in a single day are subject to 2.0 times the normal rate of pay.

- Seventh day overtime: If an employee works for the first 6 days of a work week then they are eligible for overtime if they work on the seventh day of the work week. The first 8 hours of work on the seventh day are subject to 1.5 times the normal rate of pay. Hours worked in excess of 8 hours are subject to double the normal rate of pay.

Overtime Settings to Suit California Overtime Regulations

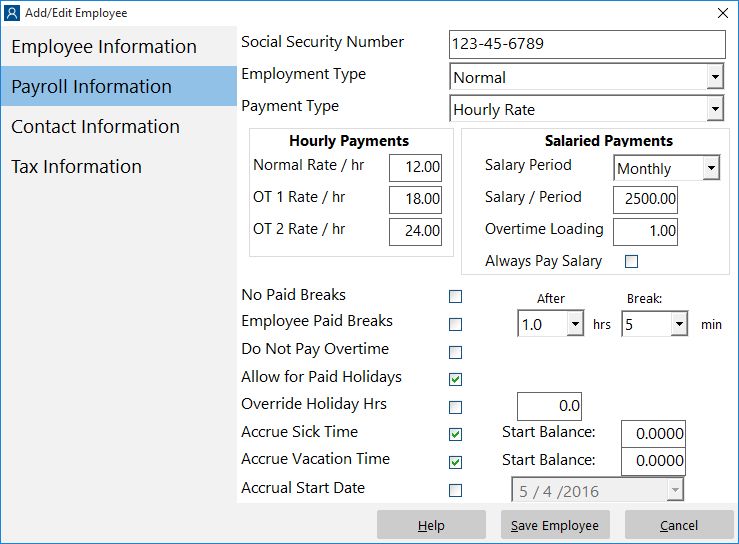

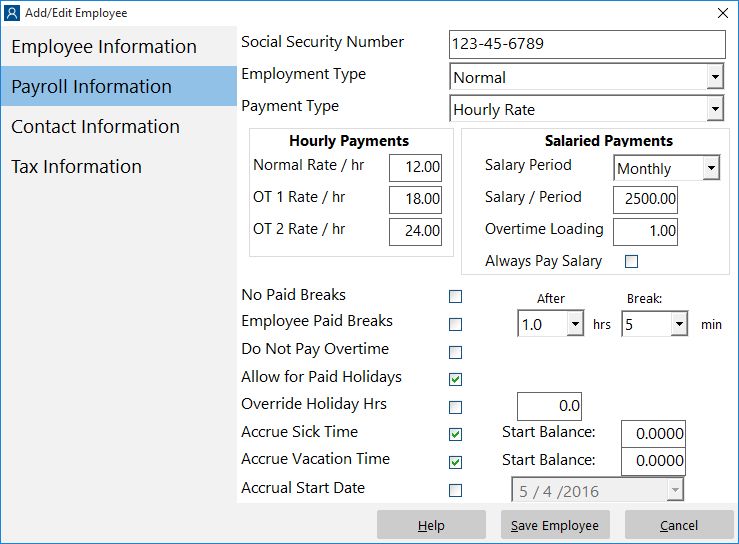

Setting up Time Clock MTS to comply with these regulations is simple. Firstly, you must edit the employee payroll information for each employee that is to receive overtime. In the first image in this post you can see an employee configured with overtime rate 1 set to 1.5 times the base rate of pay, and overtime rate 2 to double the base rate of pay. Once this is done for each employee you can then move on to the global overtime settings.

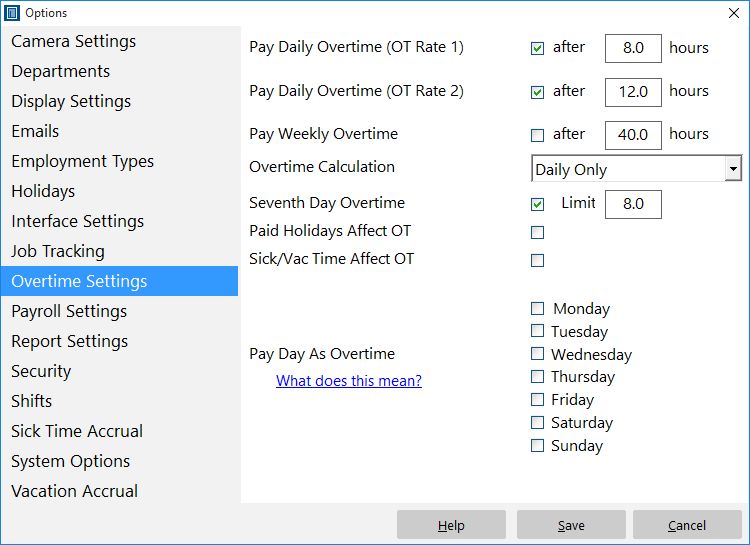

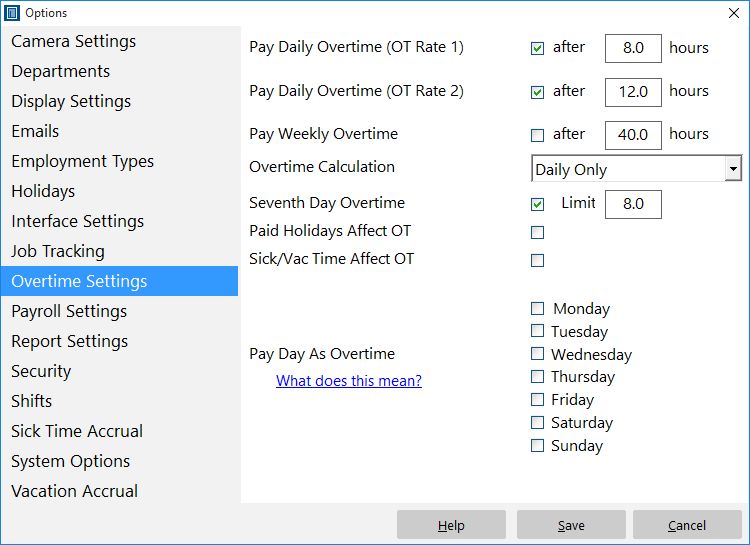

The second screenshot in this post shows Time Clock MTS configured to calculate overtime as per the Californian stipulations. Daily over time rate 1 is set to trigger at 8 hours and over time rate 2 is set to trigger at 12 hours. Weekly overtime is turned off and the calculation of overtime is set to daily overtime only. Lastly, the seventh day overtime setting is checked and the limit set to 8 hours.

In part 2 of our California overtime regulations compliance I’ll cover modifying the Time Clock MTS report section templates to display the new payment amounts covered by overtime rate 2.

by Mark Nemtsas | Jan 13, 2009 | News

As I mentioned a couple of weeks ago I’ve finally identified a hardware vendor that produces the quality fingerprint scanners that I was looking for. Digital Persona are one of the best known manufacturers in the industry, with their hardware and software drivers rapidly becoming the standard for the biometric software industry. Their popular U.are.U 4000 USB fingerprint scanner has recently been superseded by the newly designed U.are.U 4500 model and it is this model that I have settled on. I am in the process of integrating Time Clock MTS with this scanner, and in the short term at least, this and the 4000 model are going to be the only biometric devices that will work with Time Clock MTS.

A Digital Personal USB Finger Scanner

Currently Digital Persona bundles up the fingerprint scanner with some software that you can use to manage user accounts on your Windows PC and that will also manage your web passwords and so on. They currently have this bundle available at just US$69.95 which is an insanely good price considering how much it cost me for a single scanner for development purposes! You can purchase the scanners directly from the digital persona website. Please note that I am not affiliated with Digital Persona in any way, and do not currently sell their hardware so if you have any problems with the scanner then you’ll need to deal with them rather than with anyone at Timesheets MTS Software.

Stay tuned for a new version of Time Clock MTS that works with these fingerprint scanners very soon!

Update: quite a bit has changed since we wrote this entry more than five years ago. Of course Time Clock MTS has had fingerprint security for a long time. And second, Digital Persona seems to have under-gone a re-branding and no longer sells directly to consumers. If you wanted to buy a Digital Persona 4500 scanner to use with Time Clock MTS then we recommend you purchase from California PC. At the time this update was written (November 2014) it looks like a suitable fingerscanner could be purchased for under US$100.

by Mark Nemtsas | Jan 8, 2009 | How To, Tips and Tricks, Using the Software

Here’s a question I got this week that I thought was worth posting up here along with the solution:

We offer our employees vacation pay but not on an accrual basis and I canʼt seem to make the software set up a specific amount of time without accrual. For example, if any employee is consider full time for one year beyond their hire date we offer 40 hrs of paid vacation to those said employees. And every year after the next fiscal year this time starts a new 40 hrs so on and so forth. This is pretty much the same scenario in regards to sick time.

This is how to configure Time Clock MTS to allow for this sort of accrual scheme.

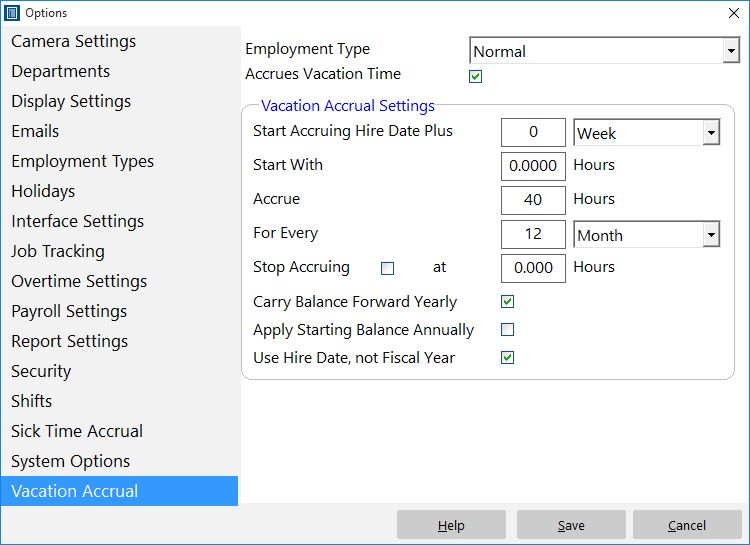

- Assign all employees with this sort of accrual to a single employment type. You could call the employment type to “yearly accrual” or whatever you like.

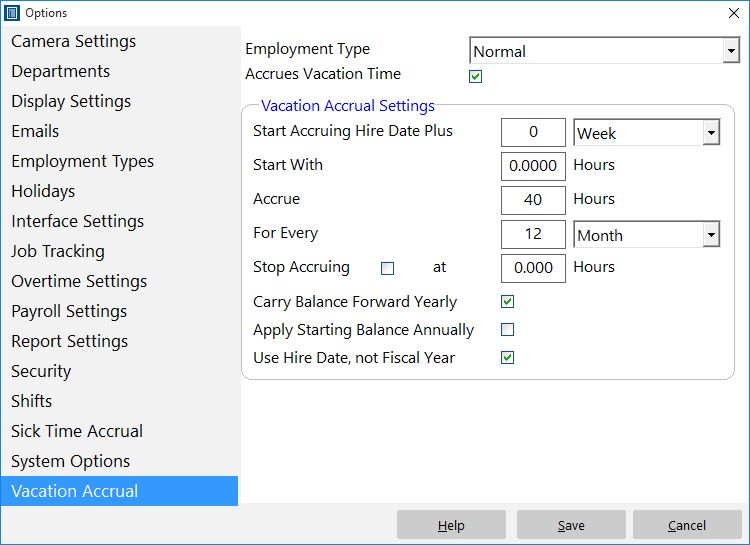

- In the administrator version of Time Clock MTS go to the Tools->Options->Vacation Accruals page and select the yearly accrual employment type you have setup.

- Check the Accrues Vacation Time check box.

- To start time accruing at hire date set Start Accruing Hire Date Plus setting to zero.

- If you want to allow for accruals in advance then set the Start With setting to some number, or otherwise set it to zero.

- Set the Accrue text field to the yearly allocation you wish to allow each employee.

- Set the For Every text box to 12 and the units drop down to Month.

- Make sure the Use Hire Date not Fiscal Year checkbox is checked to us the hire date anniversary to reset the amount of time accrued rather than the fiscal year.

Yearly Accrual Setup

There you have it, it’s not too hard and allows you a great deal of flexibility.

by Mark Nemtsas | Dec 24, 2008 | News

2008 is about to draw to a close and I thought it was a good time to summarize the year. Time Clock MTS has seen it’s usual level of development activity, with more than 30 releases this year. Most of these releases contained new features to make the software easier to use and more flexible to suit varying business requirements. As always I rely heavily on the users of Time Clock MTS to let me know what they do and dont like about the software, and these opinions help shape the development of the software. Version 2 of the software was released in June. This included a complete revamp of the reporting system as well as a slew of usability improvements. One of the more interesting new features added later in the year was the use of a webcam to capture employee images when they clock in or out.

The number of new companies using Time Clock MTS in 2008 grew by about 25% compared with 2007. This is despite the world financial crisis which has affected all of us in the last 6 months of this year. In fact, sales of Time Clock MTS in October and November were more than 30% down on the rest of the months of the year. November was in fact the worst sales month for nearly 3 years! I can only think that caution is the catch cry of the moment, with all sensible business owners riding out the storm by managing their expenditure and controlling their expenses.

Regarding the future development of the software please watch out for the integration of a fingerprint scanner with the software in the next few weeks. It’s been difficult to locate a fingerprint scanning vendor who I am happy with, one that did not have burdensome licensing requirements. I’ve finally located one such vendor (one who happens to have top class hardware) and I am working with them now to incorporate biometric security into Time Clock MTS. Watch out for this in late January or early February. I’m also trying (without much success) to get Time Clock MTS working better with payroll software. So if you use some payroll software that can import time and attendance information why not let me know what format it requires and I’ll add an export report in Time Clock MTS to suit it.

In conclusion I’d like to thank the users of Time Clock MTS who have given me valuable feedback during the year. I’d also like to thank those people who trialed the software and took the time to let me know their opinion of it even if they didn’t purchase it. There’s also the helper elves at Timesheets MTS Software that I’d like to thank, you know who you are!

Seasons greetings and happy holidays to all.